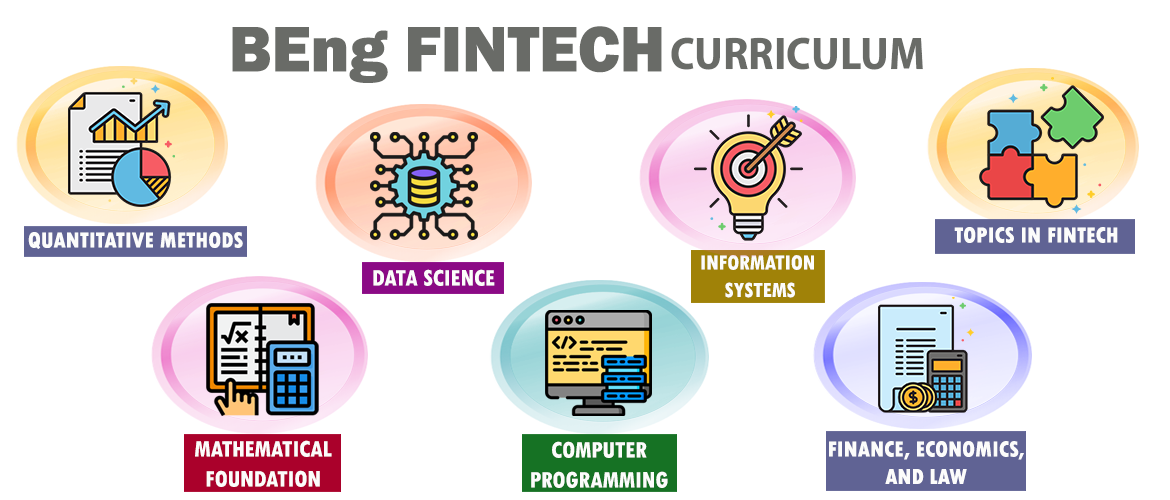

CURRICULUM

Home » Programmes » Fintech Programme

ADMISSION CRITERIA

Home » Programmes » Fintech Programme

JUPAS Admissions

Secondary school students taking Hong Kong Diploma of Secondary School Examination (HKDSE) should apply for admission through the Joint University Programmes Admissions System (JUPAS). The JUPAS code of the B.Eng. in Financial Technology Programme is “JS4428”.

Application Requirements (applicable to HKDSE applicants for 2024-25 onwards)

Admission is based on the Best 5 HKDSE subject results with subject weighting. For details of subject weighting, please refer to the table below.

| Minimum Admission Requirement | Subject | Minimum Grade | Subject Weighting |

|---|---|---|---|

| Core Subjects | English Language | 3 | 1.25 |

| Chinese Language | 3 | 1.25 | |

| Mathematics | 4 | 1.75 | |

| Citizenship and Social Development | Attained (A) | Will not be used in admission scores calculation | |

| Two Elective Subjects | Any two subjects | 3 | # |

# The Financial Technology Programme has no specified elective. The preferred subjects include Business Accounting and Financial Studies, Information and Communication Technology, Economics, Physics, Chemistry, Biology, Combined Science, Mathematics Extended Module 1 or 2.

A subject weighting of 1.5 is given to the above preferred subjects, except that 1.75 is given to Mathematics Extended Module 1 or 2. A subject weighting of 1.0 is given to any other subjects.

In addition to the requirements above, bonus points will be awarded to the 6th and 7th subjects, if any.

| Grade Point Conversion Table | |||||||

|---|---|---|---|---|---|---|---|

| HKDSE Level | 5** | 5* | 5 | 4 | 3 | 2 | 1 |

| Grade Point | 8.5 | 7 | 5.5 | 4 | 3 | 2 | 1 |

Non-JUPAS Year-1 Admissions

The programme accepts and welcomes Non-JUPAS Year 1 applicants.. Please refer to the website of the Office of Admissions and Financial Aid at https://admission.cuhk.edu.hk/ for the admission requirements of qualifications other than HKDSE. The Programme does not have specific Non-JUPAS programme requirements, though preference will be given to students with strong performance in preferred subjects. For the preferred subjects, please make reference to the HKDSE elective subjects marked with # above. Due to the diversity of non-JUPAS qualifications, applications will be assessed on individual merit.

STUDY SCHEMES

Home » Programmes » Fintech Programme

(Study Schemes – English)

Programme Title: Financial Technology (FTEC)

Study Scheme Applicable to students admitted in 2025-26

Upon completion of the Bachelor of Engineering Programme in Financial Technology, students may consider to continue their studies for the second bachelor degree in Integrated Business Administration (IBBA) subject to the prescribed admission requirements. For details, please visit to the website of the Faculty of Engineering at http://www.erg.cuhk.edu.hk/erg/ergbba

PROGRAMME REQUIREMENT

Home » Programmes » Fintech Programme

- FTEC-Study-Scheme_25-26

- FTEC-Study-Scheme_24-25

- FTEC-Study-Scheme_23-24

- FTEC-Study-Scheme_22-23

- FTEC-Study-Scheme_21-22

- FTEC-Study-Scheme_20-21

PROGRAMME DETAILS

Home » Programmes » Fintech Programme

INTERNSHIP

Home » Programmes » Fintech Programme

PLACEMENT

Home » Programmes » Fintech Programme

Examples of employers of our students:

- Commercial banks (e.g, HSBC, Bank of China (HK), Dah Sing)

- Investment banks (e.g., Goldman Sachs)

- FinTech companies (e.g., FNZ, HKAIFT)

- Asset management (e.g., Hex Trust)

- Consulting (e.g., Deloitte)

OVERSEAS EXCHANGE

Home » Programmes » Fintech Programme

Our students have participated in exchanges at various places around the globe.

- United States and Canada: e.g., Dartmouth College, Stony Brook University, University of Washington, McGill University.

- Europe: e.g., King’s College London, Université Catholique de Lille.

- Asia: e.g., Nanyang Technological University, Korea University.

ACADEMIC HONESTY

Home » Programmes » Fintech Programme

Students are required to meet the highest standard of academic honesty. All students should learn and be aware of the following standards and guidelines:

SCHOLARSHIPS

Home » Programmes » Fintech Programme

JUPAS applicants with excellent DSE results (best five total >=30) as well as Non-JUPAS applicants with excellent results in their qualification exams will be awarded a generous one-time scholarship.